First Impressions of Cake DeFi / DeFiChain for Liquidity Pools

An early-on, in-depth review of the competitive DeFi platform

There’s got to be more to investing in crypto than HODLing, right? Over these last few weeks, I’ve been diving deeper and deeper into the concept of staking and liquidity pools. Staking is fun: I’m getting 6% on BTC and 10.51% on USDT in Celsius (referral code at the bottom of this article) and a nice 12% on DOT in Kraken. But I’m interested in more.

In short, a liquidity pool is a new-ish area of decentralized finance (DeFi) in which users contribute their assets (i.e. Ethereum and the USDC stablecoin) into a pool shared with others. Other users trade, or swap, one for the other and a small fee is paid for that transaction. That fee is then shared back to the users who contributed those assets to the pool - and the potential returns from that can be large.

There are troves of information about liquidity pools but I found this particular article on liquidity pools helpful (at breaking it down (hint: if you’re not familiar with this topic and the idea of impermanent loss, there’s a lot to it so I definitely recommend at least this quick overview).

My initial dip into the “pool” was with Uniswap. I contributed $250 of ETH and $250 of DAI about four days ago. Since then I’ve made about $2.80 (approx $0.70/day). Provided the returns are consistent, that’s effectively a 51% APY. Not bad!

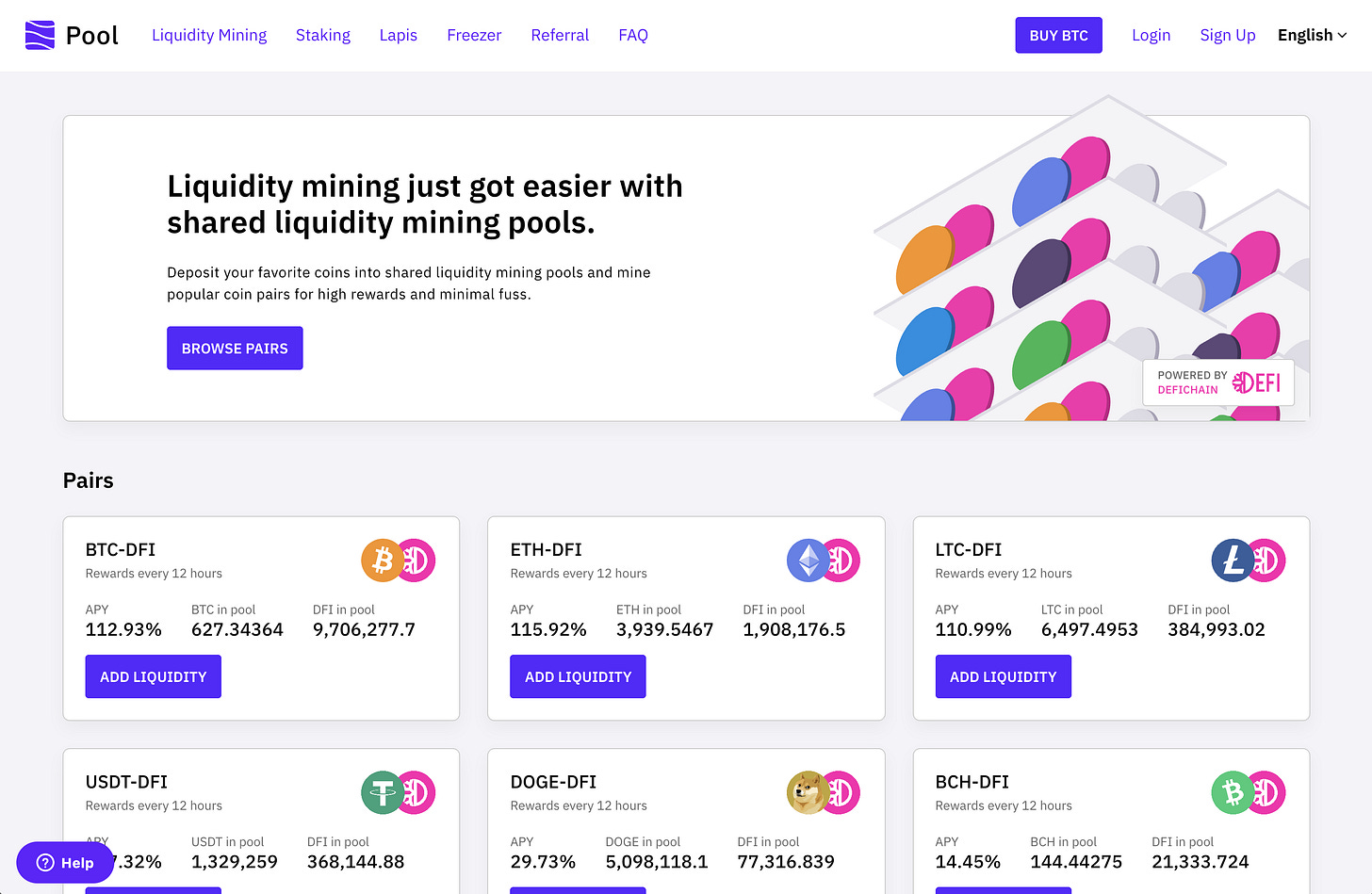

While trying to search for ways to stake my Ocean Protocol tokens outside their marketplace, I somehow stumbled onto a website called Cake DeFi and saw crazy numbers like 112%, 115, and even 146% APY from some of their liquidity pool matchups. Could this be for real, or is it a total scam?

No, I mean it - is this for real?

Uniswap was getting me a nice little return on a very small investment, but what I was seeing on Cake DeFi (essentially the business side of the DeFiChain Network) blew me away. It sounded too good to be true, so I spent my time digging further: several hours reading nearly every page on their site, their FAQs, social media accounts, dozens of YouTube videos, etc. and decided I’d give it a try. DeFiChain has been around for a few years now, but their Cake DeFi platform really kicked into gear late last summer and into winter - so you could safely say this is a fairly new platform.

Much of the media coverage made me a bit skeptical, but the reddit forum demonstrates some strong brand loyalty here. Plus, with them being relatively new and me feeling like I’m way too late to the Bitcoin craze, I was intrigued by the opportunity to jump into something that could explode. So yeah, I’m giving it a try.

Digging in

The application process was pretty simple (traditional KYC-know your customer verification - get your driver’s license ready) and instead of waiting the full 24 hours for approval, I got my notice in about 6 hours after applying. The challenging part, however, was getting some of their DFI token. I initially tried buying BTC from their interface but when that failed, I gave up and just contributed some BTC that I already had. I’m sure it was a blessing in disguise because the premium that comes along with using your credit card seems totally not worth it at all. I then exchanged BTC for some DFI on the spot, which was very convenient, but again, you pay a premium on the transfer.

After several stops and starts, I finally had the right combination of BTC and DFI to join the liquidity pool! So down the rabbit hole I went. As soon as I allocated the funds, I refreshed the page like a madman, even though it states clearly on the site that it can take up to 24 hours for the first rewards to kick in. At the time of this writing, I have already seen some of those rewards and I like what I see, but I still am in the first day of this experience.

Other products

A few other features really drew me to the Cake DeFi platform. For those who want something more traditional, they have some significantly lower-risk offerings:

Staking: This is your traditional interest-building product. They only offer it for DFI and DASH right now, but the DFI return is a very generous 37% with no commitment and rewards paid out every 3 hours.

Lapis: This is very much like a one-month CD. You lock in your assets for 28 days and your return, posted up front (typically varying between 5% up to 7.5%) is guaranteed. You read that right - guaranteed.

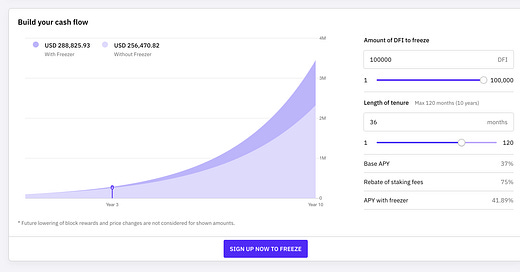

Freezer: This is like locking up your assets (from one month all the way up to ten years) in a vault that compounds even more interest over time. The returns are essentially passive income for the duration of your contract and you can comfortably build up to 42% APY, which, compounded over 10 years would be very significant. Note: the Freezer has a handy calculator and graph that shows your potential returns over time.

Which one did I choose?

As someone who loves to try new things, I did a little bit of everything. I put in about $50 for standard staking, $50 more for their Lapis product, and $50 into their freezer for 3 months. I’ll be following up later to share with you my results and thoughts.

Why Cake DeFi and a more widely-known pool?

I’ll be honest, I’m a real sucker for a good aesthetic and their site is super clean and user-friendly, and their explainer video is surprisingly very informative and entertaining at the same time. They don’t have an app (there are some security reasons associated with that) but like I said, they’re still somewhat new in this space. I also found their CEO, Dr. Julian Hosp, incredibly knowledgeable, informed, and quite charismatic. He carries with him some fallout and friction from one of his previous endeavors, but he is ALL IN on DeFiChain and Cake, so for now I’m going to him the benefit of the doubt. Cake does quarterly transparency video webinars and they’ve been produce videos literally all the time since they started ramping themselves up in mid-2020.

The DeFiChain DEX app

Outside of Cake DeFi, DeFiChain has their own DEX (decentralized exchange) app which boasts even greater returns and you get the security of holding on to your own wallet. However, I couldn’t get the app to install correctly on my laptop and I didn’t want to trust my computer to handle it. Maybe in the near future I’ll try it again but I won’t go into it in this article.

Other challenges and risks

As I mentioned earlier, getting DFI is actually not easy, especially if you live in the United States. Outside of buying the DFI coin directly from Cake or the DEX app, which came at a premium, I ended up signing up with yet another exchange, KuCoin, in which I received a much more competitive rate for transferring BTC (or USDT) to DFI. Even though it took more steps, it was definitely worth the savings. Also, with it being an online service, the saying goes: “not your keys, not your crypto.” That being said, they do have 2-factor authentication and address whitelisting available.

What does the future look like?

I think there’s so much potential here and I can’t wait to see how the next several months play out. Like any coin, there’s so much volatility and risk - so keep that in mind. DFI went from $0.20 to $3.65 in just a few months, and anything can happen in 10 years, so I doubt I’ll be committing to the full 10 year Freezer, but I’ll be spending more time on Cake in the short term to ramp up these gains.

What about OCEAN?

Oh, right! Totally forgot about OCEAN Protocol - the whole reason I got here in the first place. Don’t worry, I’ll dig into their marketplace soon.

Some Affiliate links:

If you enjoy what I’ve written, you can support me by using the links below.

Cake DeFi:

You can get $20 in DFI if you sign up. If you do, please use my code 213506 or visit https://pool.cakedefi.com?ref=213506KuCoin:

Sign up with my referral code rJEB67C or https://www.kucoin.com/ucenter/signup?rcode=rJEB67C - I’m not sure if either of us get anything from the referral, but hey, worth a shot at least, right?Celsius Network:

Want something (slightly) more traditional? Celsius Network is so far the best straight-up interest-earning app out there with some awesome rates like 6.2% for BTC and 10.51% for stablecoins like USDT/USDC. Stack both my referral code 1438216300 and promo code NEW40 to get up to $70 in rewards. https://celsiusnetwork.app.link/1438216300

Have you tried DeFi liquidity pools? Let me know what your experience has been on this or other platforms. Thanks for being part of my crypto journey.

Disclaimer: I am only providing my opinion and I am not providing you with financial advice. I write this for your education and entertainment only.